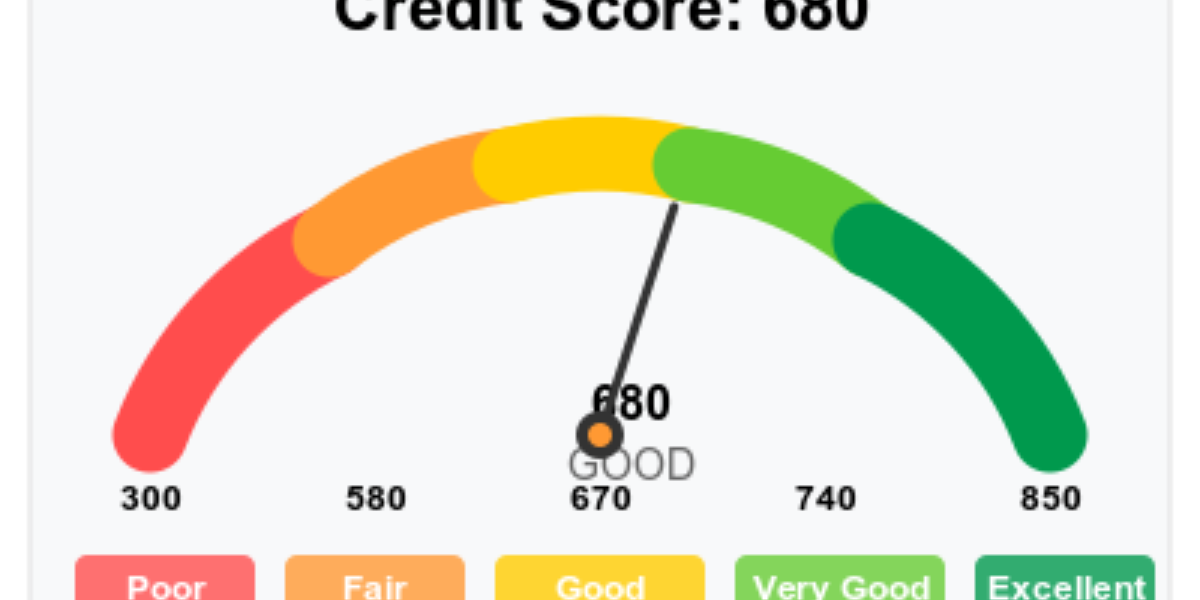

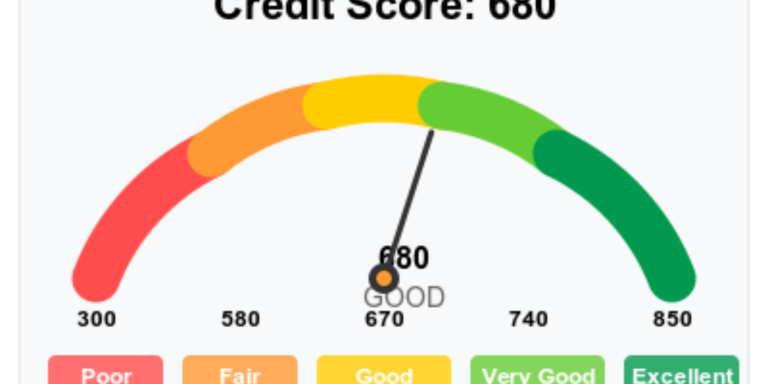

A strong credit score has become essential in today’s financial world. Whether someone wants to buy a home, secure a car loan, apply for a new credit card, or qualify for better interest rates, their credit report plays a decisive role. Unfortunately, many people struggle with damaged credit due to reporting mistakes, late payments, or […]

Author: William Mackey

Navigating Zoning Laws in Commercial Property Leasing: What You Need to Know

Zoning laws play a vital role in shaping the landscape of commercial real estate. These regulations dictate how properties in specific areas can be used, directly influencing your ability to lease commercial space for your business. Whether you’re opening a retail shop, launching a restaurant, or establishing office space, understanding the zoning requirements of a […]

How to Negotiate a Commercial Lease: Essential Tips for Securing Favorable Terms

Negotiating a lease for commercial premises is a critical step in securing a space that supports your business growth while protecting your financial interests. Commercial leases often involve complex terms and long-term commitments, so understanding how to approach the negotiation process is key to securing a deal that benefits your business. From rent and lease […]

Choosing Commercial Premises: Essential Tips for Business Owners

Choosing the right commercial premises for your business is crucial to ensuring long-term success. The location, layout, and features of a space can directly impact your operations, customer experience, and overall profitability. With so many options available, it’s important to carefully evaluate properties to find one that aligns with your specific needs. In this article, […]

Adapting to Rising Urban Housing Prices: How Buyers Are Changing Their Approach

Rising housing prices in major cities are significantly influencing the way buyers approach homeownership. For many prospective buyers, the challenge of affording a home in competitive urban markets is reshaping their purchasing decisions. From adjusting budget expectations to considering alternative neighborhoods, buyers are making tough choices to navigate the high costs associated with city living. […]

Navigating Urban Rental Markets: Tips for Securing a Property in a Competitive City

Urban areas are known for their high rental demand, often leading to a fiercely competitive housing market. With limited availability and high prices, securing a rental property in a bustling city can be challenging. Whether you’re a newcomer or a seasoned renter, understanding the dynamics of urban rental markets and employing the right strategies can […]

The Future of the Housing Market: Is a Boom or Bust on the Horizon?

The housing market has experienced significant fluctuations over the last few decades, with periods of booming growth followed by sudden downturns. As we look ahead to the coming years, many wonder whether the market is heading for another boom or a potential bust. Understanding the factors driving these changes is key to predicting the market’s […]

Understanding the Link Between Fed Rate Changes and Credit Card Interest

Federal Reserve (Fed) rate decisions have a direct impact on credit card interest rates. The Fed controls the federal funds rate, which is the rate at which banks lend to each other overnight. This benchmark influences many other interest rates, including those on credit cards. When the Fed raises or lowers the rate, it has […]

How Fed Interest Rate Changes Impact Inflation and Consumer Spending

The Federal Reserve (Fed) plays a crucial role in managing the U.S. economy, particularly through its interest rate policies. By adjusting the federal funds rate—the rate at which banks lend to each other—the Fed aims to influence inflation and consumer spending. Low interest rates generally encourage spending, while high rates are used to cool inflation. […]

The Impact of Low Fed Rates on Cryptocurrency Investment: Opportunities and Risks

Low Federal Reserve interest rates have significant implications for investment strategies, particularly in digital assets like cryptocurrencies. When the Fed lowers its rates, it makes borrowing cheaper, encouraging more investment across various sectors. For digital assets, this environment creates a ripe opportunity for growth. Investors seeking higher returns often look beyond traditional assets like stocks […]