Federal Reserve (Fed) rate decisions have a direct impact on credit card interest rates. The Fed controls the federal funds rate, which is the rate at which banks lend to each other overnight. This benchmark influences many other interest rates, including those on credit cards. When the Fed raises or lowers the rate, it has a ripple effect on the cost of borrowing for consumers. In this article, we’ll explore how Fed rate changes affect credit card interest rates, what it means for your debt, and how you can manage your payments more effectively.

Why Credit Card Interest Rates Are Tied to the Fed Rate

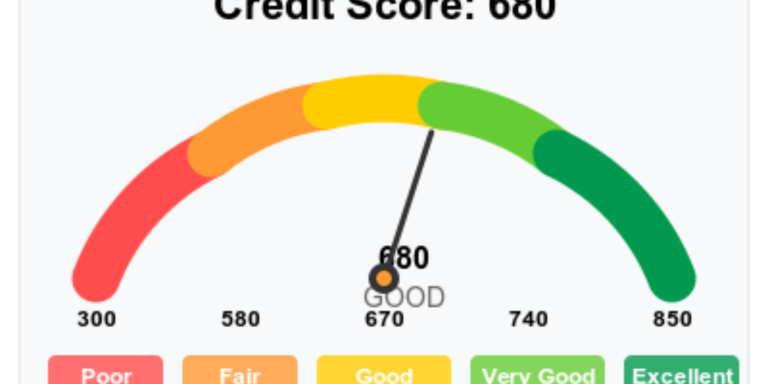

Credit card interest rates are typically variable, meaning they fluctuate based on changes in the federal funds rate. Most credit cards have an interest rate known as the Annual Percentage Rate (APR), which consists of a base rate (the prime rate) plus a margin determined by the credit card issuer. The prime rate is directly influenced by the federal funds rate. When the Fed raises or lowers its rate, the prime rate follows, which in turn affects the APR on your credit card.

Immediate Impact of Rate Changes

Unlike fixed-rate loans, such as mortgages, credit cards respond quickly to changes in the federal funds rate. When the Fed raises rates, credit card companies typically adjust the APR within one or two billing cycles. This means that if the Fed announces a rate hike, your credit card interest rate could increase in a matter of weeks, leading to higher interest charges on any outstanding balances.

How the Prime Rate Works

The prime rate is usually about 3% higher than the federal funds rate, and it serves as the foundation for most variable-rate credit cards. For example, if the federal funds rate is 2%, the prime rate would be approximately 5%. Credit card issuers then add a margin—often between 10% and 15%—on top of the prime rate to determine your APR. Therefore, any change in the federal funds rate has a proportional impact on your credit card interest rate.

The Effect of Fed Rate Hikes on Credit Card Debt

When the Fed raises interest rates, the cost of carrying a balance on your credit card increases. Higher APRs mean more of your monthly payment goes toward interest, rather than reducing your principal balance. This can make it harder to pay down debt and lead to a longer repayment period. Even a small rate hike can significantly increase the amount you pay in interest over time, especially if you carry a large balance.

How Much More You’ll Pay

Let’s say you have a $5,000 balance on your credit card with a 15% APR. If the Fed raises rates by 0.25%, your APR could increase to 15.25%. While this may seem like a small difference, over time it adds up. At a 15% APR, your monthly interest charge would be around $62.50, but at 15.25%, it rises to $63.54. Over the course of a year, this 0.25% hike would cost you an additional $12.48 in interest. For larger balances, the increase is even more significant.

Impact on Minimum Payments

Higher interest rates can also affect your minimum payments. Credit card issuers calculate minimum payments based on a percentage of your outstanding balance, often 1% to 3%, plus any interest charges. As your APR rises, so do your interest charges, which means your minimum payment could increase. This can strain your budget, especially if you’re already struggling to keep up with payments.

How Fed Rate Cuts Can Benefit Credit Card Holders

When the Fed lowers rates, it provides relief to credit card holders by reducing the cost of borrowing. Lower rates mean lower APRs, which translate to reduced interest charges for consumers who carry balances. This allows more of your monthly payment to go toward the principal, helping you pay off debt faster. However, the impact of rate cuts can vary based on how much your card’s APR is tied to the prime rate.

Quicker Debt Repayment

With lower interest rates, consumers have an opportunity to pay down their balances more quickly. A reduction in the APR means that less of your payment goes toward interest, allowing you to reduce the principal faster. For example, if your APR drops from 15% to 14.5%, the interest on a $5,000 balance would decrease from $62.50 to $60.42 per month. This reduction in interest costs accelerates your debt repayment, potentially saving you hundreds of dollars in the long run.

Opportunities for Refinancing

During periods of falling interest rates, some credit card companies offer promotional APRs or balance transfer deals with lower rates. Consumers can take advantage of these offers to consolidate debt from higher-interest cards onto a card with a lower APR, further reducing interest charges. These opportunities can be particularly beneficial when the Fed lowers rates, as credit card issuers become more competitive in attracting customers.

Managing Your Credit Card Debt During Fed Rate Changes

Whether the Fed is raising or lowering rates, managing your credit card debt effectively is key to minimizing costs and maintaining financial health. Rate hikes can make carrying a balance more expensive, while rate cuts present opportunities to pay down debt faster. By understanding how Fed rate changes influence your credit card, you can make informed decisions about how to handle your finances.

Paying Down High-Interest Debt

If you carry a balance on your credit card, especially during a period of rising interest rates, focus on paying off high-interest debt as quickly as possible. Making larger payments or paying more than the minimum can help reduce the impact of rising APRs. Additionally, consider transferring balances to cards with lower interest rates or 0% introductory APR offers to save on interest charges.

Locking in Fixed-Rate Alternatives

One way to avoid the unpredictability of variable-rate credit cards is to consider fixed-rate alternatives. Personal loans or debt consolidation loans typically offer fixed interest rates, which remain stable even if the Fed raises rates. By consolidating credit card debt into a fixed-rate loan, you can protect yourself from future rate hikes and create a more predictable repayment schedule.

Monitoring Your APR

Credit card holders should regularly monitor their APRs, especially during periods of rate changes. Many issuers notify cardholders of rate adjustments in advance, giving you time to prepare. Knowing when your APR is set to increase allows you to adjust your budget and payment strategy accordingly. If you notice that your interest rate is rising, consider paying down more of your balance to avoid higher interest costs.

Fixed vs. Variable-Rate Credit Cards

While most credit cards have variable rates tied to the prime rate, some offer fixed rates. Fixed-rate credit cards can provide stability in periods of rising Fed rates, as the interest rate remains constant regardless of changes in the federal funds rate. However, fixed-rate cards may come with higher initial APRs than variable-rate cards, and issuers can still increase the rate under certain conditions, such as missed payments or defaults.

Advantages of Fixed-Rate Cards

For consumers who prefer predictability, fixed-rate cards offer the advantage of consistent interest rates. Even if the Fed raises rates multiple times, your APR will remain unchanged, allowing you to budget more effectively. This can be particularly useful for consumers who carry a balance and want to avoid the risk of rising rates.

Disadvantages of Variable-Rate Cards

Variable-rate credit cards can be beneficial in low-rate environments, as their APRs are typically lower than those of fixed-rate cards. However, they come with the risk of rate hikes when the Fed increases the federal funds rate. Consumers with variable-rate cards may see their interest charges rise quickly during periods of monetary tightening, making it harder to manage debt.

Preparing for Future Rate Changes

The Fed’s decisions on interest rates are driven by economic conditions, including inflation, employment, and overall growth. While rate changes are often announced in advance, it’s important to stay prepared for both rate hikes and cuts. Paying attention to Fed statements and economic indicators can give you insight into when your credit card APR may change, allowing you to take proactive steps in managing your debt.

Building an Emergency Fund

Building an emergency fund can help protect you from the financial strain of rising interest rates. With a cushion of savings, you’re less likely to rely on credit cards for unexpected expenses, reducing the amount of interest you pay over time. Aim to save enough to cover at least three to six months of living expenses, which can help you avoid accumulating high-interest credit card debt.

Creating a Debt Repayment Plan

A solid debt repayment plan can help you stay ahead of interest rate changes. Prioritize paying off high-interest balances first, and consider using the debt snowball or avalanche method to tackle multiple debts. By focusing on reducing your principal balance, you can minimize the impact of rising interest rates and save money in the long run.

Understanding how Fed rate decisions influence credit card interest rates can help you make smarter financial decisions. Whether rates are rising or falling, taking proactive steps to manage your credit card debt will ensure you stay in control of your finances.