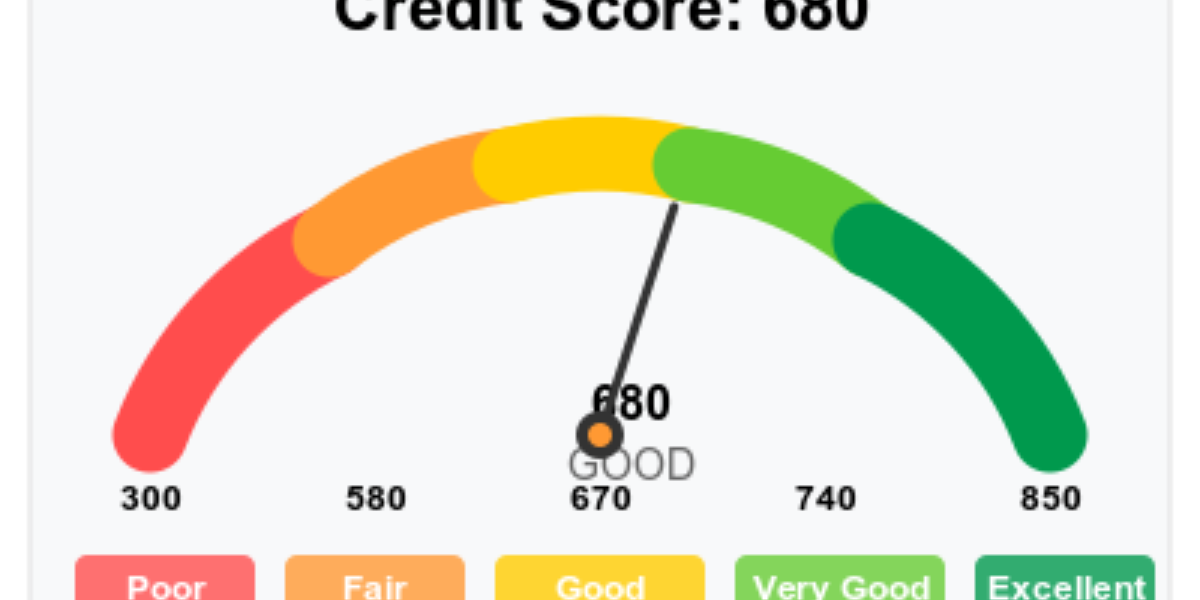

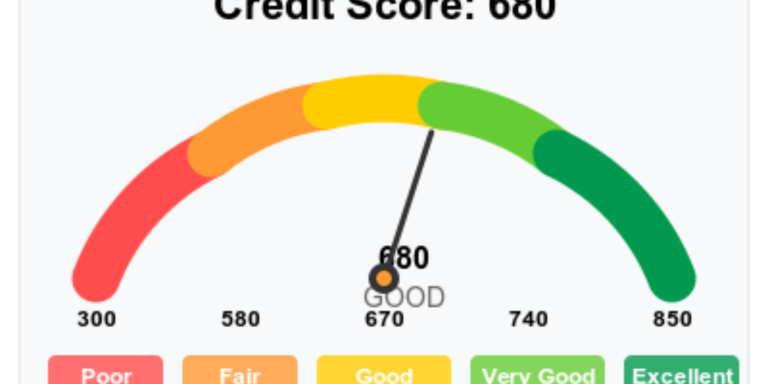

A strong credit score has become essential in today’s financial world. Whether someone wants to buy a home, secure a car loan, apply for a new credit card, or qualify for better interest rates, their credit report plays a decisive role. Unfortunately, many people struggle with damaged credit due to reporting mistakes, late payments, or past financial challenges. This is where credit repair offers a structured and effective solution.

Credit repair helps individuals review their credit reports, spot inaccurate information, and dispute questionable entries. Over time, this process can significantly improve credit scores, paving the way for better financial opportunities. As more consumers look for guidance in this area, interest in tools, resources, and even a credit repair affiliate program continues to grow.

Why Credit Repair Is More Important Than Ever

Credit reports often contain errors—incorrect balances, outdated accounts, duplicated entries, or fraudulent activity. Even a single mistake can lower a credit score and make borrowing more expensive. That is why being proactive matters.

The credit repair process helps consumers:

-

Identify errors that negatively affect credit scores

-

Challenge inaccurate or unverifiable information

-

Understand key factors that influence credit scoring

-

Build better long-term financial habits

-

Create strategies to maintain strong credit health

With financial awareness increasing, credit repair services are becoming more necessary for everyday consumers.

The Value of Professional Credit Repair Services

While individuals have the right to dispute credit report errors on their own, many prefer the expertise of professional credit repair companies. These specialists understand consumer protection laws, know how to communicate with creditors, and use a step-by-step plan to improve credit accuracy.

Typical credit repair services include:

-

Detailed review of reports from all major credit bureaus

-

Identifying inaccurate, outdated, or questionable entries

-

Preparing customized dispute letters

-

Communicating with credit bureaus and lenders

-

Providing ongoing guidance for positive credit building

This professional structure helps people achieve faster, more reliable results.

Credit Repair and Financial Growth

Improving credit isn’t just about boosting a number—it’s about unlocking financial freedom. A stronger credit score can help consumers secure lower interest rates, reduce monthly payments, and increase approval chances for loans and credit cards. Over time, these benefits can lead to significant savings.

Credit repair also encourages better long-term habits, such as timely payments, lower credit utilization, and maintaining diverse credit types. These habits strengthen financial stability, helping consumers move toward a more secure future.

A Growing Industry With New Opportunities

As credit awareness continues to expand, so does interest in supplemental income opportunities—especially through a credit repair affiliate program. These programs allow bloggers, influencers, and financial educators to earn commissions by recommending reputable credit repair services. With so many people searching for credit improvement guidance, a credit repair affiliate program offers a reliable way to provide value and earn income simultaneously.

Final Thoughts

Credit repair has become an essential part of financial empowerment. By correcting errors, improving habits, and gaining clarity about credit scoring, consumers can build stronger financial foundations. At the same time, growing interest in credit education has made opportunities like a credit repair affiliate program more popular than ever, creating a win-win environment for consumers and marketers alike.