Rising housing prices in major cities are significantly influencing the way buyers approach homeownership. For many prospective buyers, the challenge of affording a home in competitive urban markets is reshaping their purchasing decisions. From adjusting budget expectations to considering alternative neighborhoods, buyers are making tough choices to navigate the high costs associated with city living. This article will explore how escalating housing prices are affecting buyer behavior in major urban areas and what trends are emerging as a result.

The Surge in Housing Prices in Major Cities

Over the past few years, housing prices in major metropolitan areas have soared, driven by a combination of strong demand and limited supply. Cities like San Francisco, New York, and London have seen home values rise dramatically, making it increasingly difficult for buyers to afford properties in central locations. This surge has been fueled by several factors, including population growth, economic prosperity, and low-interest rates. However, for many buyers, the steep cost of entry into the housing market is leading to significant shifts in how and where they purchase homes.

Supply Constraints Driving Prices Up

One of the main reasons for rising home prices in major cities is the ongoing shortage of housing supply. In many urban areas, new construction has failed to keep pace with population growth, leading to a supply-demand imbalance. Zoning restrictions, limited available land, and lengthy approval processes for new developments all contribute to this shortage. As a result, homes that do come on the market often spark bidding wars, driving prices even higher and pushing many buyers out of the market.

Demand from High-Income Buyers

In addition to supply constraints, demand from high-income buyers is also contributing to rising housing prices. As more people move into cities for high-paying jobs in sectors like tech, finance, and healthcare, competition for desirable properties intensifies. These buyers often have larger budgets, allowing them to outbid other prospective buyers, further increasing home values in already expensive areas.

Affordability Concerns and Their Impact on Buyers’ Decisions

As housing prices continue to rise, affordability is becoming a major concern for many buyers, particularly first-time homebuyers. With the cost of entry into the market growing, prospective homeowners are being forced to make difficult decisions about their finances and where they want to live. This is leading to shifts in buyer behavior as they look for ways to cope with the affordability crisis.

Expanding the Search Area

In response to rising prices in central urban areas, many buyers are expanding their search to outlying neighborhoods or suburbs. These areas often offer more affordable housing options, even though they may be further from city centers. Buyers are increasingly prioritizing value over location, willing to accept longer commutes in exchange for more reasonably priced homes. In cities like Los Angeles or London, this trend has led to growth in housing demand in surrounding regions, as buyers seek alternatives to the high costs of inner-city living.

Choosing Smaller Homes or Condos

Another way buyers are adjusting to rising prices is by opting for smaller homes or condos instead of larger, single-family homes. In many major cities, buyers are willing to sacrifice space to stay within their budgets. Condominiums, in particular, are becoming an attractive option for buyers who want to live in urban areas but can’t afford the higher prices of standalone homes. Downsizing expectations allows buyers to enter the market, even if it means purchasing a property that’s smaller than originally planned.

Shift Toward Renting and Delaying Homeownership

For some prospective buyers, the rising cost of homes has led to a shift away from purchasing altogether. In many cities, renting has become a more viable option, especially for individuals who aren’t ready to commit to long-term homeownership in an expensive market. This trend is particularly strong among younger buyers, who are delaying the purchase of a home in favor of renting while they save for a larger down payment or wait for more favorable market conditions.

Renting as a Strategic Decision

For many, renting is no longer viewed as a temporary solution but as a strategic decision to avoid the high costs of buying in an overheated market. With rent prices often lower than mortgage payments in many cities, renters can save money for a future purchase or invest in other assets. Additionally, renting provides flexibility, allowing individuals to move if they need to relocate for work or if housing prices in their desired area become more affordable in the future.

First-Time Buyers Facing Challenges

First-time homebuyers are particularly affected by rising housing prices. Without the equity that existing homeowners have built up, first-time buyers often struggle to come up with large down payments. Many are turning to alternative financing options, such as shared ownership schemes or co-buying with friends or family members, to make homeownership possible. However, even with creative financing, the high cost of entry remains a significant barrier for this group.

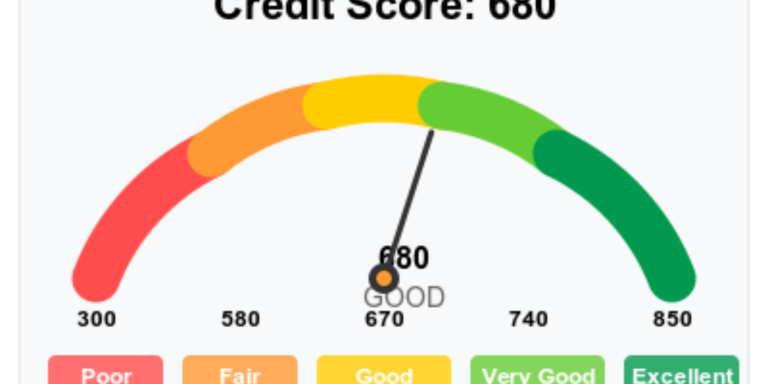

The Role of Mortgage Rates in Buyer Decision-Making

While rising home prices are a major factor influencing buyers’ decisions, mortgage rates also play a crucial role. Low-interest rates over the past several years have made borrowing more affordable, allowing buyers to stretch their budgets further and afford higher-priced homes. However, as interest rates begin to rise in response to inflationary pressures, the cost of mortgages will increase, potentially reducing buyers’ purchasing power.

How Rising Mortgage Rates Affect Affordability

When mortgage rates rise, monthly payments on new home loans become more expensive, which can significantly impact a buyer’s budget. For example, a 1% increase in mortgage rates can add hundreds of dollars to monthly payments, reducing the overall affordability of a home. As interest rates climb, some buyers may find themselves priced out of the market, particularly in cities where housing prices are already high. This could lead to a slowdown in demand, as fewer buyers can afford to purchase homes at current price levels.

Locking in Low Rates

To mitigate the effects of rising mortgage rates, many buyers are rushing to lock in lower rates before they increase further. By securing a mortgage at a lower rate, buyers can protect themselves from future rate hikes and ensure their monthly payments remain manageable. This strategy is particularly important in competitive urban markets, where even small increases in mortgage rates can make a big difference in a buyer’s ability to afford a home.

Impact of Rising Housing Prices on Investment Decisions

Rising housing prices are also influencing investment decisions, as real estate investors seek to capitalize on the appreciation of home values. In major cities, many investors view housing as a safe and profitable investment, particularly in areas where demand is high and supply is limited. However, as prices continue to rise, some investors are becoming more cautious, wary of potential market corrections or bubbles.

Investing in Rental Properties

One of the main trends among real estate investors in major cities is the focus on rental properties. With demand for rental housing growing, particularly in high-cost markets, many investors are purchasing properties to rent out rather than flip for a quick profit. This strategy allows investors to generate a steady stream of income while benefiting from long-term appreciation in property values. However, as home prices rise, the initial investment required to purchase rental properties is also increasing, making it more challenging for investors to enter the market.

Potential Risks of Overpriced Markets

While rising prices may seem like a positive sign for investors, there are also risks associated with overpriced markets. If home prices continue to rise unchecked, there is a possibility that the market could enter a bubble, leading to a sharp decline in values if demand weakens or interest rates rise too quickly. Savvy investors are cautious about overextending themselves in these markets, opting for more conservative investment strategies to protect against potential downturns.

Conclusion: How Buyers Are Adapting to Rising Housing Prices

Rising housing prices in major cities are reshaping the way buyers approach homeownership. From expanding search areas and opting for smaller homes to choosing to rent or delay purchases, prospective buyers are adapting to the challenges of affordability in competitive urban markets. As prices continue to climb and mortgage rates potentially rise, the trends influencing buyer behavior will continue to evolve, making it essential for buyers to stay informed and flexible in their decision-making process. Understanding these dynamics is key to successfully navigating the high-cost urban housing market.