When the Federal Reserve increases its benchmark interest rate, it affects borrowing costs across various types of consumer loans. As a result, mortgages, car loans, and personal loans become more expensive for borrowers. The Federal Reserve, or “Fed,” raises rates to control inflation by making borrowing more costly, thus cooling down consumer spending and economic growth. Higher interest rates trickle down to banks and other lenders, leading to increased loan costs for consumers. In this article, we’ll explore the direct impacts of Fed rate hikes on different types of consumer loans.

How Fed Rate Hikes Impact Mortgages

Mortgage rates closely follow the Federal Reserve’s decisions. When the Fed raises rates, it increases the cost of borrowing for lenders, who in turn pass those costs on to consumers. For homebuyers, this means higher monthly mortgage payments as interest rates climb. A 1% rate hike can add hundreds of dollars to a typical monthly mortgage payment. Over the course of a 30-year mortgage, these increases compound, significantly raising the total cost of homeownership. Fixed-rate mortgages are affected less immediately compared to adjustable-rate mortgages (ARMs), where rate adjustments can happen periodically.

Fixed-Rate vs. Adjustable-Rate Mortgages (ARMs)

Fixed-rate mortgages lock in the interest rate for the entire loan term, offering stability. Even during rate hikes, borrowers with fixed rates won’t see their payments rise. However, ARMs are subject to rate adjustments, usually once a year after an initial fixed period. Borrowers with ARMs face more unpredictability, and when the Fed raises rates, their monthly payments can spike.

Refinancing and Fed Rate Increases

Consumers looking to refinance their homes are also impacted. Higher rates mean fewer opportunities to lower monthly payments through refinancing, as the new rate might not offer enough of a reduction to justify the cost. Homeowners who miss the opportunity to refinance before a rate hike may find themselves locked into higher rates.

Rising Fed Rates and Car Loans

Car loans are another area where Fed rate hikes increase costs for borrowers. Typically, car loans have shorter terms than mortgages, but even a small rate increase can make a significant difference in monthly payments. Lenders adjust car loan interest rates based on the cost of borrowing from the Federal Reserve. As the Fed raises rates, financing a new or used vehicle becomes more expensive.

Long-Term vs. Short-Term Car Loans

The impact of rate hikes on car loans varies by loan term. Short-term loans of 36 months or fewer see smaller changes in monthly payments because there is less time for interest to accumulate. On the other hand, long-term loans of 60 to 72 months are more sensitive to rate increases, with higher overall interest paid over the life of the loan. This can deter consumers from financing vehicles or push them to opt for cheaper models to keep monthly payments within their budget.

Leasing vs. Buying

Consumers leasing cars may also feel the impact, as lease terms are influenced by prevailing interest rates. Higher borrowing costs for automakers trickle down into leasing contracts, raising the price of monthly lease payments. Buyers and lessees alike should anticipate increased costs during Fed rate hikes.

Personal Loans and Fed Rate Hikes

Personal loans, typically used for debt consolidation, home improvements, or major purchases, are heavily impacted by changes in Fed rates. These loans often come with variable interest rates, meaning borrowers could see their payments rise as rates increase. Even fixed-rate personal loans can become more expensive as lenders adjust their rates to match the higher cost of borrowing.

Debt Consolidation Loans

Consumers using personal loans to consolidate high-interest debt may find less relief during periods of rising Fed rates. As loan interest rates rise, the benefits of consolidating credit card debt or other liabilities into a single loan diminish. Borrowers might pay more in interest over time, reducing the savings they hoped to achieve through debt consolidation.

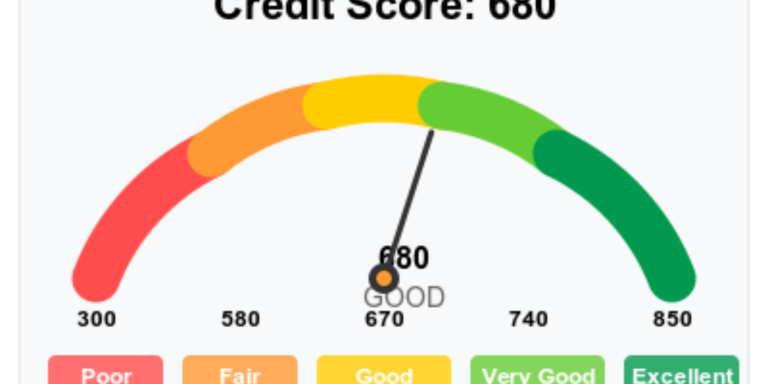

Impact on Credit Scores

Higher interest rates can also affect credit scores indirectly. As loan payments increase, consumers may struggle to meet their monthly obligations, leading to missed or late payments. Missed payments can lower a consumer’s credit score, making it harder to qualify for favorable loan terms in the future.

How to Manage Loans During Rate Hikes

Understanding how rate hikes impact your loans is key to managing your finances. While rising rates are inevitable during inflationary periods, there are ways to minimize their effects. For consumers with existing loans, locking in fixed rates where possible can provide stability. For those shopping for new loans, comparing lenders and securing the best possible interest rate before further hikes can help manage costs. Refinancing existing debt, while rates are still relatively low, is another way to stay ahead of future increases.

Consider Loan Prepayment

Prepaying your loans can be an effective strategy to combat rising interest rates. By paying off loans faster than scheduled, you reduce the amount of interest that accrues over time. This is especially helpful for long-term loans like mortgages or student loans, where interest compounds over decades.

Shop for the Best Rates

Consumers should always shop around for the best loan rates, especially during periods of rising rates. Different lenders offer varying terms, and finding the lowest available rate can save you thousands over the life of a loan. Utilizing online comparison tools makes it easy to evaluate your options before committing to a loan.

How Rising Rates Impact Consumer Spending

The Fed’s goal in raising rates is to slow down consumer spending and control inflation. As loans become more expensive, consumers are less likely to borrow money for large purchases like homes, cars, or renovations. This slowdown in borrowing can reduce demand across various industries, from real estate to automotive sales, and even retail. When spending slows, businesses may experience lower revenues, leading to reduced economic growth.

Housing Market

Higher mortgage rates often lead to decreased demand for homes, as potential buyers are priced out of the market due to higher monthly payments. This cooling effect can result in slower home price growth or even declines in some markets, as fewer buyers can afford homes at elevated interest rates.

Automotive Industry

The automotive industry is also affected by rising borrowing costs. Car sales often decline when consumers are unable to secure affordable financing. Dealers may offer fewer incentives or discounts during these periods, further impacting affordability.

Fed Rate Hikes and Credit Card Debt

While mortgages and personal loans are directly impacted by Fed rate hikes, credit card debt is another area where consumers feel the pinch. Credit card interest rates are typically variable, meaning they fluctuate based on the Federal Reserve’s actions. When the Fed raises rates, credit card companies increase their interest rates accordingly, making it more expensive to carry balances from month to month.

Managing Credit Card Debt

To avoid accumulating high-interest debt during periods of rising rates, consumers should aim to pay off their balances in full each month. If paying off balances isn’t possible, transferring debt to a card with a 0% introductory APR offer or a lower fixed rate can provide some relief.

Impact on Minimum Payments

Higher interest rates increase the portion of credit card payments that go toward interest rather than principal. As a result, it may take longer to pay off balances, and minimum payments may increase. Keeping balances low and prioritizing high-interest debt can help mitigate these challenges.