When people talk about financial freedom, the image often looks different depending on who you ask. For some, it means traveling the world without worrying about money. For others, it is about retiring early, paying off debts, or simply being able to sleep at night without stressing over bills. No matter your age, financial background, or goals, the idea of financial freedom touches everyone. It’s a universal concept that fuels dreams, influences decisions, and shapes the way we live.

Understanding Financial Freedom

Financial freedom is not just about having wealth; it is about control. It’s the ability to make choices without being limited by financial constraints. For younger generations, that might mean avoiding student loan traps and starting life without heavy debt. For mid-career professionals, it could mean saving enough to handle emergencies without relying on credit cards. And for retirees, it might mean enjoying a comfortable lifestyle without worrying about outliving their savings. The core of financial freedom is independence, flexibility, and security.

Why Financial Freedom Matters

Money alone does not guarantee happiness, but financial stability removes barriers that often cause stress and limit opportunities. Imagine the peace of mind that comes from knowing you can pay your bills, cover unexpected expenses, and still save for the future. Financial freedom allows you to invest in your passions, whether it’s starting a business, pursuing education, or spending time with family. It’s less about the dollar amount and more about the freedom of choice and the life you design for yourself.

Steps Toward Financial Freedom

Reaching financial freedom does not happen overnight. It requires consistent effort, smart decisions, and sometimes sacrifices. Here are some essential steps to get closer to that goal:

- Create a budget: Track your income and expenses. This simple step helps you understand where your money is going.

- Build an emergency fund: Saving three to six months’ worth of living expenses can protect you against unexpected financial shocks.

- Pay off debt: High-interest debt is one of the biggest obstacles to financial freedom. Focus on reducing credit card balances, loans, and other liabilities.

- Invest for the future: Retirement accounts, stocks, or real estate can grow your wealth over time and give you long-term security.

- Stay disciplined: Avoid lifestyle inflation. As your income grows, don’t increase your spending at the same pace.

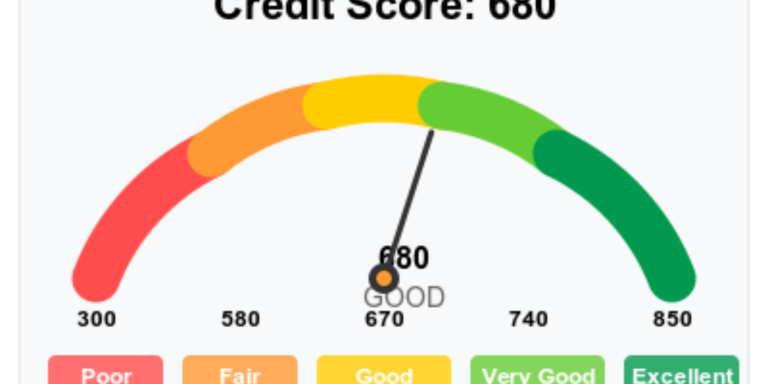

The Role of Credit in Financial Freedom

Credit, when used wisely, can be a powerful tool for achieving financial freedom. A good credit score can unlock lower interest rates, better loan opportunities, and financial flexibility. However, mismanaging credit can trap you in debt cycles that delay your goals. The balance lies in using credit strategically—borrowing when it enhances your future potential, like for education or a home, while avoiding high-interest traps such as payday loans or unnecessary consumer debt.

Generational Perspectives on Financial Freedom

Different age groups often view financial freedom differently. Teenagers and young adults might see it as being able to pay for their own expenses without asking parents for help. Millennials often focus on paying off student loans and building savings while balancing lifestyle choices. Generation X tends to worry about both raising children and saving for retirement at the same time. Baby Boomers, nearing or in retirement, see financial freedom as the ability to live comfortably without financial stress. Despite the differences, the desire for financial independence is universal.

Common Roadblocks to Financial Freedom

Many people struggle to achieve financial freedom because of recurring obstacles. These include overspending, lack of savings, poor debt management, and unexpected life events like medical bills or job loss. Understanding these challenges is the first step to overcoming them.

Table: Common Financial Roadblocks and Solutions

| Roadblock | Impact | Solution |

|---|---|---|

| High-interest debt | Limits savings, adds stress | Prioritize debt repayment, consolidate loans |

| Lack of savings | Unprepared for emergencies | Set up automatic transfers to savings |

| Impulse spending | Derails long-term goals | Use budgeting apps, track expenses |

| Income instability | Unpredictable cash flow | Diversify income, build emergency fund |

Building Wealth for the Long Term

Achieving financial freedom is not just about cutting costs. It is equally about growing wealth. Investing, whether in retirement accounts, real estate, or businesses, helps create streams of income that continue to grow even when you are not working. This long-term strategy is what separates people who are always worried about money from those who can confidently say they have achieved financial freedom.

Table: Saving vs. Investing

| Aspect | Saving | Investing |

|---|---|---|

| Risk level | Low | Medium to High |

| Growth potential | Limited | Significant over time |

| Liquidity | High | Varies |

| Purpose | Short-term security | Long-term wealth |

Practical Habits for Everyday Financial Freedom

Even small changes in your daily routine can help build toward financial independence. For example, cooking meals at home instead of dining out, canceling unused subscriptions, or practicing mindful spending can free up significant amounts of money over time. Financial freedom doesn’t mean never spending—it means spending wisely in ways that align with your goals and values.

- Track expenses daily with a mobile app

- Set short-term and long-term financial goals

- Learn basic financial literacy concepts

- Plan big purchases in advance instead of impulsively

The Emotional Side of Financial Freedom

Financial freedom is as much emotional as it is practical. Being free from financial stress improves mental health, relationships, and overall quality of life. People who achieve financial freedom often report feeling more confident, secure, and optimistic about their future. They also tend to be more generous, giving back to their communities and helping others along the way. In this sense, financial freedom goes beyond the individual and creates a ripple effect in society.

Your Journey Toward Financial Freedom

Financial freedom is not reserved for the wealthy. It is attainable for anyone willing to plan, take action, and remain disciplined. Whether you are starting with your first paycheck or planning for retirement, the steps toward financial freedom remain the same: spend less than you earn, save consistently, invest wisely, and avoid unnecessary debt. Along the way, remember that the journey is just as important as the destination. With patience, persistence, and smart financial habits, you can design a life that truly reflects your goals and values. That is the essence of financial freedom.